Part 1 – Transparency

Picture this…

A small business owner, juggling a million things at once, trying to keep your business afloat and make it thrive. In the midst of this whirlwind, the concept of corporate governance may seem like something reserved for big corporations and boardrooms, but not for them, the small fish in the pond.

Sounds familiar??

Here’s the thing, corporate governance matters to all, and it can be a game-changer for your small business. It is not just for the corporate giants; it’s for you too. It’s about protecting your business, strengthening its foundation, and paving the way for long-term success. I know it’s a heavy and sort of dry topic but give me a chance to simplify.

What is Corporate Governance?

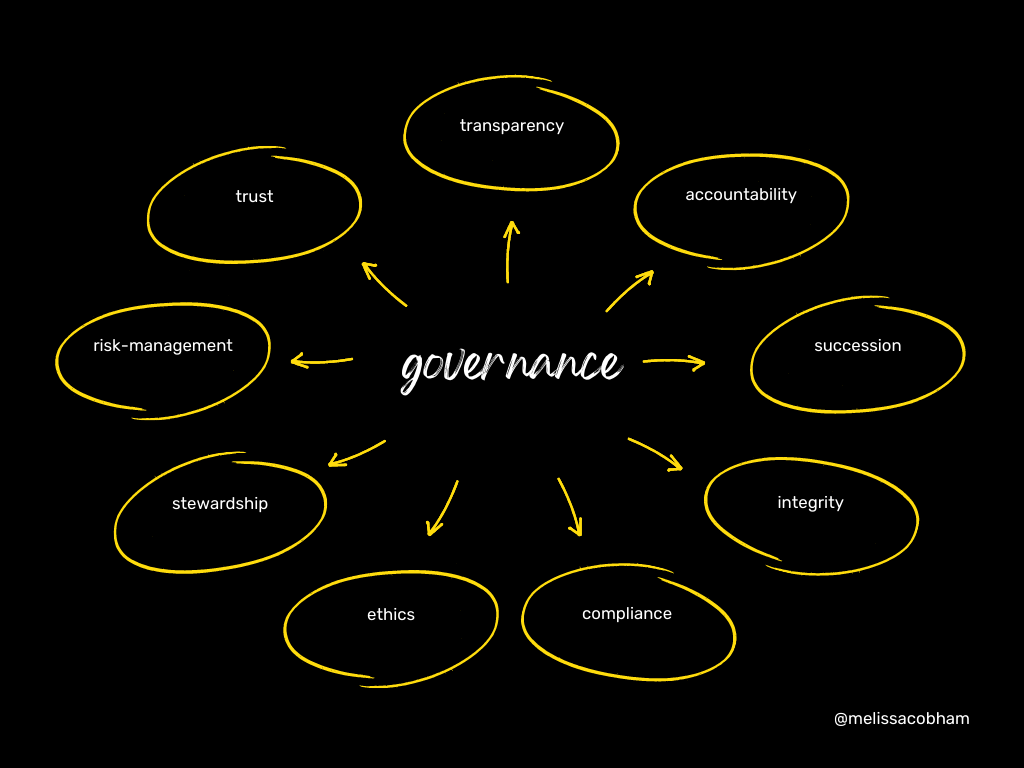

Corporate governance is the framework that outlines how your company is managed and controlled, as well as the goals you aim to achieve. It involves determining who has the authority and final decision-making power within your business. Governance provides structure by defining clear roles and responsibilities for everyone involved.

One of the critical aspects of governance is managing risks to protect and preserve your company’s assets. By adopting good governance practices, your company can establish a culture of transparency and accountability, ensuring that decision-making processes seek the interest of all stakeholders and are open and responsible.

Prioritizing governance helps build trust among your stakeholders, including employees, customers, suppliers, collaborators, and investors. It also includes planning for the future by considering succession and ensuring the long-term sustainability of your business.

In essence, governance serves as the foundation for your company’s operations, enabling effective management, risk mitigation, transparency, accountability, and the cultivation of trust with stakeholders. It provides the framework for a successful and well-governed organization.

Lessons to be Learned from the Enron Debacle

The Enron scandal was notorious for corporate fraud and unethical practices that shook the business world. While Enron was a large corporation, there are valuable lessons that I believe you and other small businesses can learn from. By understanding what went wrong, you can avoid similar pitfalls and foster a culture of good governance.

Enron Corporation was an American energy company founded in 1985. It was once considered one of the largest and most innovative companies in the world, specializing in energy, commodities, and services. However, Enron’s downfall came in the early 2000s when a massive accounting scandal was exposed, leading to its bankruptcy and the subsequent dissolution of the company.

The scandal involved inequity, fraudulent accounting practices and widespread corporate misconduct. Enron employed complex financial structures and off-balance-sheet entities to manipulate their financial statements, creating an illusion of profitability and financial stability. These practices allowed Enron to hide debt, inflate revenue, and deceive investors and analysts.

The revelations of the fraud caused a dramatic loss of investor confidence and led to the collapse of Enron. The scandal also raised questions about the role of auditors and regulatory oversight, as well as the ethical standards within the corporate world.

Enron’s downfall had far-reaching consequences, including the enactment of stricter accounting and corporate governance regulations such as the Sarbanes-Oxley Act in 2002. The scandal served as a significant turning point in the corporate governance landscape, emphasizing the importance of transparency, accountability, and ethical conduct in business operations.

The Enron scandal provides valuable lessons for small businesses. Each of these lessons offers insights into areas where a small business can learn from including transparency, the importance of accurate financial reporting, implementing internal controls, and having independent and competent leadership.

Transparency – Saying What You Mean and Meaning What You Say

Transparency is a key ingredient in building trust with your stakeholders. Think about it – your reputation, or let’s call it your brand, is the lifeline of your business. Word-of-mouth recommendations can make or break you in the small business world. People are more likely to trust and buy from you if they’ve heard good things about you. But here’s the catch – they won’t refer you if you’re not seen as credible, if you consistently fail to deliver on your promises, or if your actions don’t align with your words. It’s like shooting yourself in the foot!

Another thing to be wary of is being selective with information. It’s like playing a game of hide and seek with your stakeholders, keeping them in the dark and leaving them guessing.

A dangerous game I’ll say…

To build trust, you need to be upfront and communicate openly. Let people know who you are, what your business stands for, and what your agenda is. Transparency is the key to maintaining trust and establishing long-lasting relationships. It also involves creating an open channel for stakeholders to communicate with you, provide feedback, and feel safe to report any concerns or whistle-blow if necessary.

It peeves me when I learn about businesses that discriminate based on customer status or gender. Have you ever experienced being treated differently or receiving subpar service simply because you’re a woman? It’s infuriating! Whether it’s dealing with a mechanic, hiring a contractor, or negotiating a bulk discount for your inventory, it is unacceptable to be treated unfairly until you bring a male representative into the picture. This kind of behavior is a prime example of poor governance. It demonstrates a lack of transparency, fairness, and equal treatment.

As a small business, it’s crucial to prioritize good governance practices that promote honesty, integrity, and inclusivity. Treat all your customers with respect, regardless of their gender, background, or any other factor. Remember, your reputation and success are built on how you treat and serve all your stakeholders. By embracing transparency, you can foster trust, build strong relationships, and establish your business as one that values open communication and equality.

There is always a lesson to be learned from all failed experiences. The Enron scandal reminds us of the dire consequences of neglecting governance principles and that corporate governance is not a topic reserved for large corporations but is equally relevant and vital for small businesses and their stakeholders.

“Good governance for your business is synonymous with protecting your personal brand. It’s a reflection of your values, integrity, and commitment to ethical conduct. By prioritizing transparency, accountability, and responsible decision-making, you elevate both your business and your own reputation.” – Melissa Cobham

The views reflected in this newsletter are the views of the author and do not necessarily reflect the views of Aegis Business Solutions, its partners, or any affiliated companies.

The contents of this article are specifically tailored to small businesses that are incorporated, rather than those operating as sole proprietors.

If you found value in this article, I encourage you to share it with other women entrepreneurs who can also benefit from the insights. Feel free to message me with your suggestions for future topics to explore.

Stay tuned for my next article (part 2 of 3) in which we will delve into the importance of accurate financial reporting and implementing internal controls.

Cheers to your continued success! Look forward to chatting with you soon. 😊