Part 2 – The importance of accurate financial reporting and implementing internal controls

Honest Business – The Power of Accurate Financial Storytelling

In the world of business, your financials are more than just numbers on a page. They hold the power to shape your brand’s reputation and your overall value. I firmly believe in the importance of crafting a true and compelling financial story—one that accurately reflects your business’s journey, even in your absence.

Your financial reports serve as a vital tool in telling this story. They go beyond mere figures; they paint a picture of your financial health and performance. Investors, employees, partners, and suppliers all seek to understand your progress and evaluate your ability to effectively manage resources and achieve your goals. By presenting accurate and transparent financial information, you instill confidence and build trust among your stakeholders.

A win!

But the value of accurate financial storytelling doesn’t end there. It extends to you, the business owner. Your financial reports provide you with invaluable insights and data that enable you to measure your progress, detect any anomalies, and make strategic adjustments to propel your business forward.

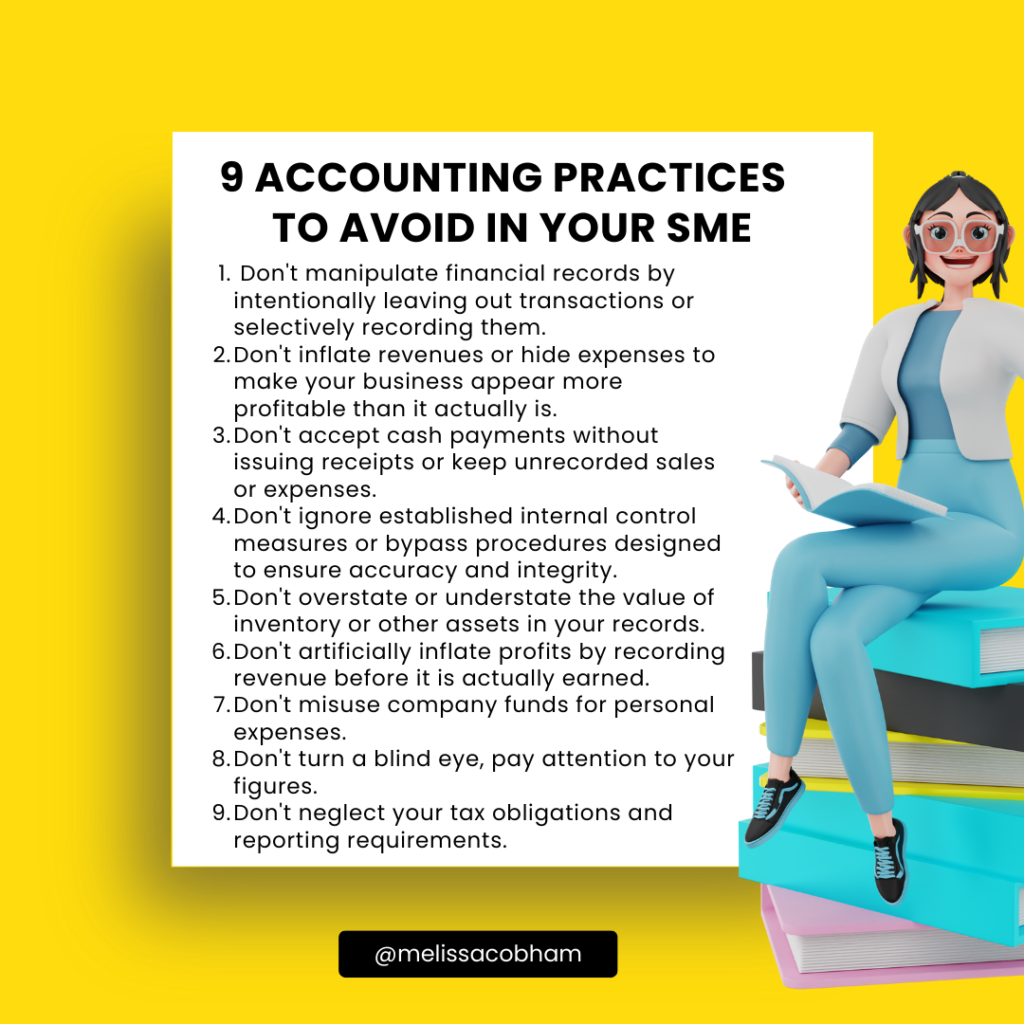

Let me be clear, when I talk about strategic adjustments, I’m not referring to creative accounting or “cooking the books.” It’s about using the data and insights from your financial reports to make informed decisions that drive your business’s growth and success.

Here is an example, let’s say your reports reveal a decline in sales during a particular period. Instead of resorting to deceptive accounting practices to manipulate the numbers, you can dig deeper to identify the root causes and take corrective actions. Perhaps you need to refine your strategy, improve product quality, or optimize operational efficiency. By addressing these underlying issues honestly and transparently, you set your business on a path of sustainable growth.

Engaging in deceptive accounting practices can have severe consequences. Not only does it damage your reputation and erode trust among stakeholders, but it can also lead to legal repercussions and financial penalties. The short-term gains from manipulation are far outweighed by the long-term detriments of losing credibility and facing potential business collapses like the case of Enron or even our CLICO and Hindu Credit Union scandal right here in our sweet Trinidad and Tobago.

What’s in the dark always comes to light; it’s not about playing tricks with the numbers; it’s about using your financial reports as a roadmap to navigate your business’s journey with integrity and purpose.

Remember this!!! Your financial story is a powerful asset—one that can elevate or diminish the perception of your brand and your personal value.

Being the Ultimate Ambassador of Internal Controls to Protect Your Business

I hate to break it to you, but there’s no way around it – you must champion the implementation of internal controls within your organization. Don’t worry too much. Being an ambassador of internal controls doesn’t mean drowning in bureaucracy or incurring hefty costs. It’s about taking proactive measures to safeguard your business from risks, ensure accurate financial reporting, and prevent fraudulent activities.

By embracing the role of ambassador, you demonstrate your commitment to maintaining transparency, accuracy, and trust in your operations. Think of yourself as the captain of your ship, steering it in the right direction and keeping it on course.

Trust me! You don’t want to sail through stormy waters without the proper controls in place.

How Do You Go About Implementing Said Internal Controls?

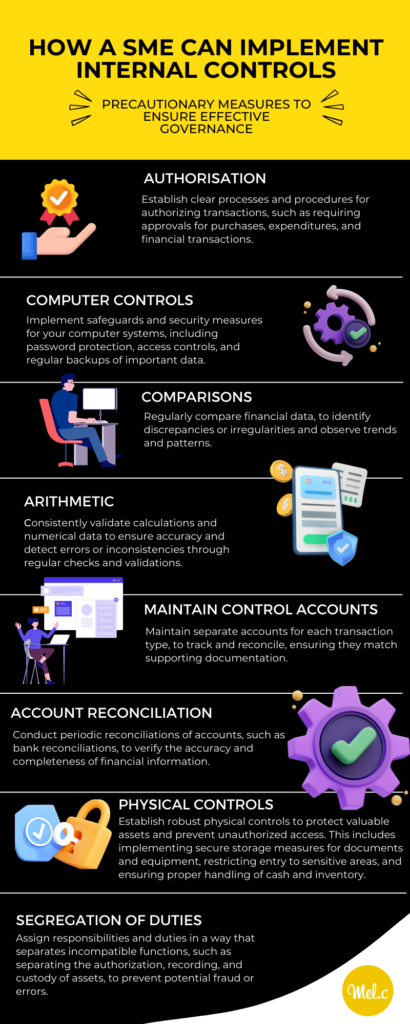

There is this acronym I use called “ACCAMAPS”. I came across it during my journey to become an accountant. It stands for Authorisation, Computer controls, Comparison, Arithmetic, Maintaining control accounts, Account reconciliations, Physical controls, and Segregation of duties. Each element plays a crucial role in strengthening your internal controls, and the best part is, you can tailor them to fit your unique business needs. It’s like having a customized toolkit to fortify your defenses.

In the day-to-day operations of your business, things can get complex and unpredictable. That’s why you need ammunition to steer your ship in the right direction. Adopting internal control principles is like arming yourself with the necessary tools to protect your business, boost stakeholder confidence, and ensure smooth operations.

Remember, it’s always better to be proactive than reactive. Your business and your brand are on the line, so take control and sail confidently into success.

“Steer your business with integrity and purpose, for it is better to proactively navigate the rippled waters of success than to reactively face the storms of uncertainty. Take the helm, embrace control, and sail confidently toward a future of honesty and triumph” – Melissa Cobham

The views reflected in this newsletter are the views of the author and do not necessarily reflect the views of Aegis Business Solutions, its partners, or any affiliated companies.

The contents of this article are specifically tailored to small businesses that are incorporated, rather than those operating as sole proprietors.

If you found value in this article, I encourage you to share it with other women entrepreneurs who can also benefit from the insights. Feel free to message me with your suggestions for future topics to explore.

Stay tuned for my next article (part 3 of 3) in which we will delve into the significance of having independent and competent leadership.

Cheers to your continued success! Look forward to chatting with you soon. 😊